“Vanabhudhi”, Oil on Canvas, Wendy Beresford

Did you know how much your parents earned? Do you know how much your friends, spouse or partner earn, or what their net worth is? Do you know what your net worth is? I would say, for a lot of us, the answer to these questions is no. It’s simply not polite to talk about money. I can just hear my grandmother sniffing disapprovingly, “Its not correct, dear”.

Our handling of the subject of money is very similar to our handling of the subject of death. They are both things we all, without exception, face and deal with at some point, and yet… we’re not really supposed to talk about them. Subjects such as wills, retirement funds, taxes and debt are usually fraught with discomfort. And, tragically, we learn to avoid them, despite the fact that our very avoidance of them causes untold stress and pain, and comes at a huge cost, every time.

This code of silence causes us to bury our heads in the sand when it comes to our money, our worth, our sense of value… and even our self-care, as taking responsibility for our finances IS a most vital act of self-care. That’s what I did for years. I worked hard, earned money and gave it away in all sorts of different ways. My money past is littered with daft purchases, unconscious spending patterns, exchanging money for love and control, as well as many, many acts of handing over control of my money to third party “experts” and “authorities”. And, (no surprise here as money is a mirror for me), I have done exactly the same with my talents and, certainly, my art, over the years.

When I reached the point of knowing that I had to step up and make a change to see a change, one of the scariest realisations was that I now had to confront the past, along with all the shame, guilt and judgement that came with it. But scariest of all was the thought of the action I had to take to remedy things. Please note that I said it was the thought of the action that was scary, not the action itself – very important difference that I was soon to learn.

For a while I sat very still, hoping someone would miraculously appear and do it all for me. There was a lot to do. I had to find out information, talk to financial people, banks, insurance companies and lawyers, I had to ask for help, I had to ask questions that probably sounded stupid, I had to risk being vulnerable. Above all, I had to admit I didn’t know everything, and that I had been winging it for the most part of my life, hoping that everything would turn out OK without any input or direction from me. Part of me felt I should know what to do and it should feel easy – that’s what all the books tell you don’t they? Inspired or right action is always effortless? But it didn’t feel that way. Change was going to stretch me way beyond my comfort zone. I felt overwhelmed and didn’t know where to start.

I wish I could tell you different, but no one appeared to do it for me. However, as I began to take infinitesimally baby steps for myself, help and support and guidance did appear, sometimes miraculously and often inexplicably.

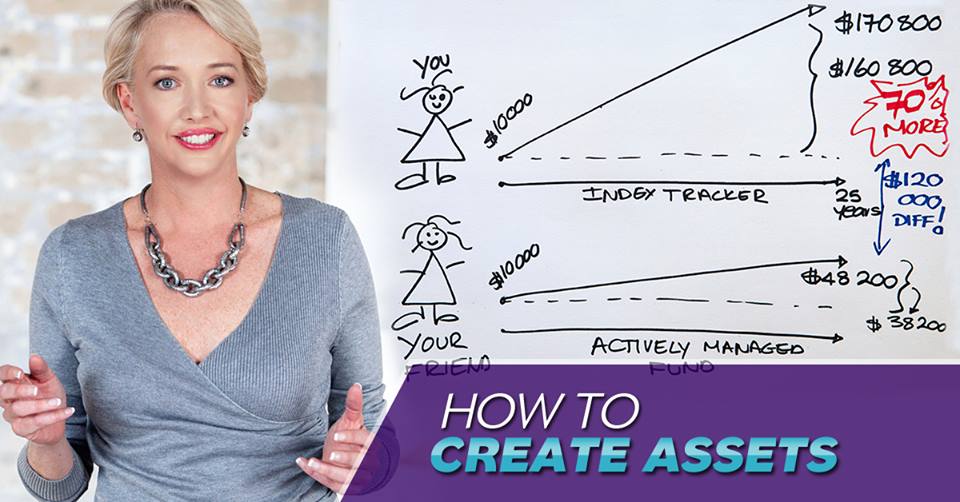

From my viewpoint, the financial industry protects itself by making us feel as though we are incapable of managing our own money. It plays on our ignorance and our fear of our ignorance, our fear of talking about money. It uses fear and comparison tactics to shepherd us towards buying its services and products. So often, it makes empty promises to take care of it all for us so we don’t have to worry our pretty heads about it. Did you know that over 80% of actively managed investments (where we pay big costs to have a financial advisor or team make the decisions) don’t outperform a simple index tracker investment (one that simply tracks the performance of a given market or market sector via a computer and is therefore hugely more cost effective)?

There are good financial advisors with integrity out there – I even know one – and there are sharks, but I soon realised that anyone who was advising me I was better off handing over responsibility to them was to be avoided at all costs. That strategy had got me where I was, not where I wanted to be. So, step by step, I asked the dumb questions, faced the bureaucratic bullshit from banks and insurance companies, put my head down and stuck firm to my vision – to become a savvy, empowered leader for my own money. And, guess what? Taking the action was far less scary than thinking about it! In fact it was empowering. Every person, situation and opportunity taught me something new, whether through negative or positive consequences, and I began to change.

The journey to financial self-empowerment takes patience. None of it happened as fast as I wanted and there were times when I did feel overwhelmed, and still do. There were times when I did fall back into thinking about taking action, instead of taking action, and that’s all OK. But with each step my support base grew, and joining Ann’s Financial Freedom University was a watershed step. That’s when I really felt I had the support and guidance to take the next step, and the next. Now when I look back, I see my money journey in two distinct parts – pre and post FFU. Having access to her experience and knowledge as well as to a like-minded community made the world of difference. To find myself in a place where I could talk as openly about money as I wanted, where I could voice all my fears and dreams, was a healing balm to my little financial wizard soul!

This is why I’m talking about this now, in a public forum, when my Scorpio Ascendent would much rather slip away unnoticed and watch from afar! We all need to heal the shame that silence around money has bred. These issues, and so much more, are delved into deeply in FFU. The course opens for registration just once a year and that’s happening today. Click here to find out more. If you haven’t had a chance to watch Ann’s free videos yet, you can still do that for a few days more before they’re taken down and FFU begins. That, in itself, is a momentous first step. I will keep sharing my experiences and insights gained in my money journey, and if you’d like to hear more from me, you’re welcome to subscribe to my blog below.

Till next time, much love xxx